Currency exchange and currency exchange

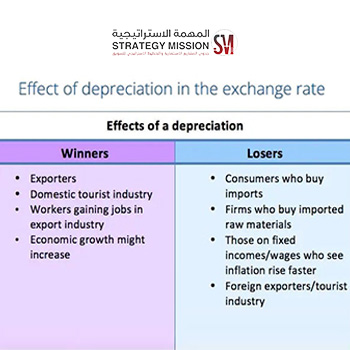

How do currency exchange rate changes affect our business? Who are the winners and who are the losers?How can the company be protected from these effects and reduce losses?

Follow the tweets below and share with us…

To request administrative and marketing systems development services:

https://www.strategymission.org/en/request-services/

Are currency exchange rates only of interest to bankers or major importers?

Of course not…

The change in currency exchange rates is a risk of a relative change in the value of currencies, which can directly affect income and expenditure, cash liquidity or profits.

This change negatively affects the following categories:

– Consumer importers.

– Imported manufacturers of raw materials.

– Suppliers of materials whose prices are fixed or highly competitive.

– Logistics companies.

– Tourism workers.

– Re-export trade.

How can these risks be minimized?

– The validity date of the quotation you offer to customers must be fixed and not be long or open validity.

– Transfer all expenses to the most stable currency, whether domestic or foreign, to ensure the lowest risk margin.

In the event of rapid changes in a few months you can raise the price of your services by the average percentage so that losses are offset immediately and directly, but while avoiding losing customers so the step should be very calculated.

Study the market and official banking data in the country in which it operates or through accurate analyses of market movement.

– If you are a net local company but you manage some hard currency transactions such as paying salaries, import cost and others, you should include a margin for losses in anticipation of changing exchange rate.

– One of the most important accounting standards relevant to this situation is the IAS21 standard.

No comment